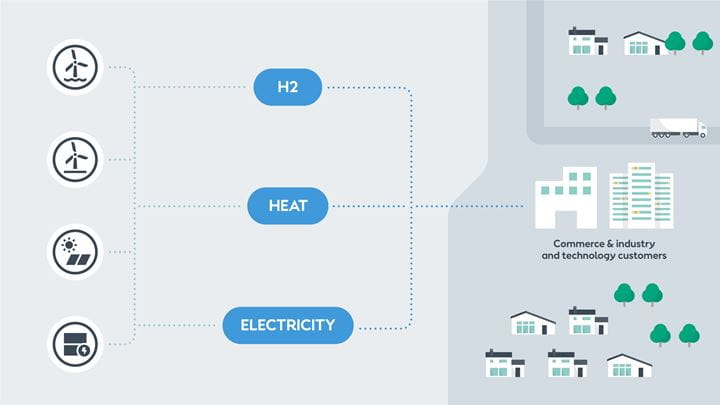

Roughly 73% of global emissions that cause climate change come from the use of energy, mainly through burning of fossil fuels for power, heat, cooling, transportation and industrial processes. This means that the global transition to renewable energy is one of the most important ways of fighting climate change.

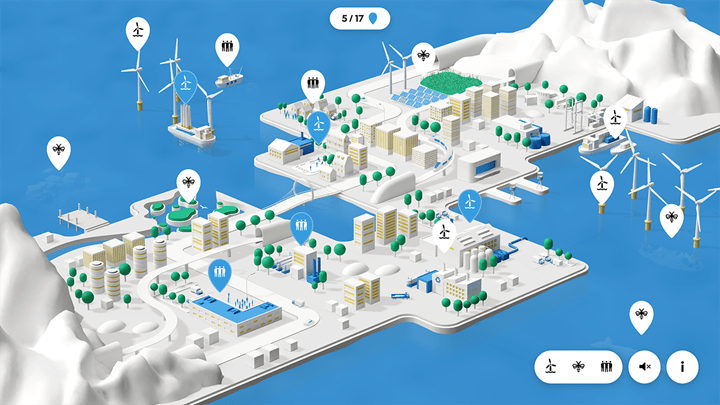

At Ørsted, we’ve been at the forefront of the massive global expansion of offshore wind over recent decades, and today we also provide onshore wind and solar power , as well as exploring new green energy technologies like renewable hydrogen and green fuels.

Thanks to our

green transformation, we’re well ahead of schedule in terms of the science-based carbon-reduction targets to meet the terms of the Paris agreement. Now we want to help other companies and countries undergo their own green transformations, working together to

create a world that runs entirely on green energy